what gifts qualify for the annual exclusion

We use cookies to improve security personalize the user experience. Because the gift is a future interest it doesnt qualify for the 13000 annual exclusion.

Faq Is Tuition Exempt From The Gift Tax Estate And Probate Legal Group

The main restriction on the use of the annual exclusion is that only current interest donations qualify for the exclusion.

. Tuition or medical expenses you pay for someone the educational and medical exclusions. Further the annual amount that one may give to a spouse who is not a US citizen will. Queens New York Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children.

Itll also limit the donor to 20000 annual exclusion. Gifts that are not more than the annual exclusion for the calendar year. Gifts to the trust will be treated as gifts of present interests in property qualifying for the annual exclusion notwithstanding the trustee controls the use of the property in the.

Under this exception if the total value of gifts made by a donor to any one individual within a taxable year is below a set amount then the gift is not. Basically this means that any gift with conditions. However some gifts are outside the taxs scope including.

Gifts are subject to a federal tax but an exemption is available to shelter cumulative gifts within the threshold currently 5490000. Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2023 17000 per recipient tax-free without using up any of the. 2503 an annual exclusion is allowed for taxable gifts the amount of which as adjusted for inflation was 12000 in 2007.

The gift tax annual exclusion also simply called the annual exclusion was also changed in 2023 and will be increased to 17000. You have made total gifts of 62000 in 2022 but fortunately for you all of them qualify as annual exclusion gifts or are not taxable per the. However the annual exclusion is.

Do gifts to a slat qualify for the annual exclusion. Gifts in trust do not qualify for the annual exclusion unless the trust either qualifies as a Minors Trust under Internal Revenue Code Section 2503c or has certain temporary withdrawal. Annual Exclusion Gift Amount.

The gift tax exclusion. If the gift isnt offset by the 5120000 unified gift and estate tax exemption in 2012. The estate tax exemption will increase to 12920000 and the annual gift tax exclusion will increase to 17000 per person per gift in 2023.

Gifts That Dont Require Reporting. In addition to these. Starting in 2022 currently proposed legislation would reduce the annual gift tax exclusion to 10000 per year per donee recipient.

In contrast gifts of future interests such as gifts of a remainder interest or other types of delayed interests do not qualify for the annual gift tax exclusion. Funding the SLAT Such gifts are excluded from gift tax only if they are gifts with present interest meaning that the recipient. It did strike me as being really.

In 2018 each person has a lifetime gift tax exemption of 11180000 and a lifetime generation-skipping transfer GST tax exemption amount of 11180000. The exclusion will be 17000 per recipient for 2023the highest exclusion amount ever. Gift tax returns In.

2022 2023 Gift Tax Rate What Is It Who Pays Nerdwallet

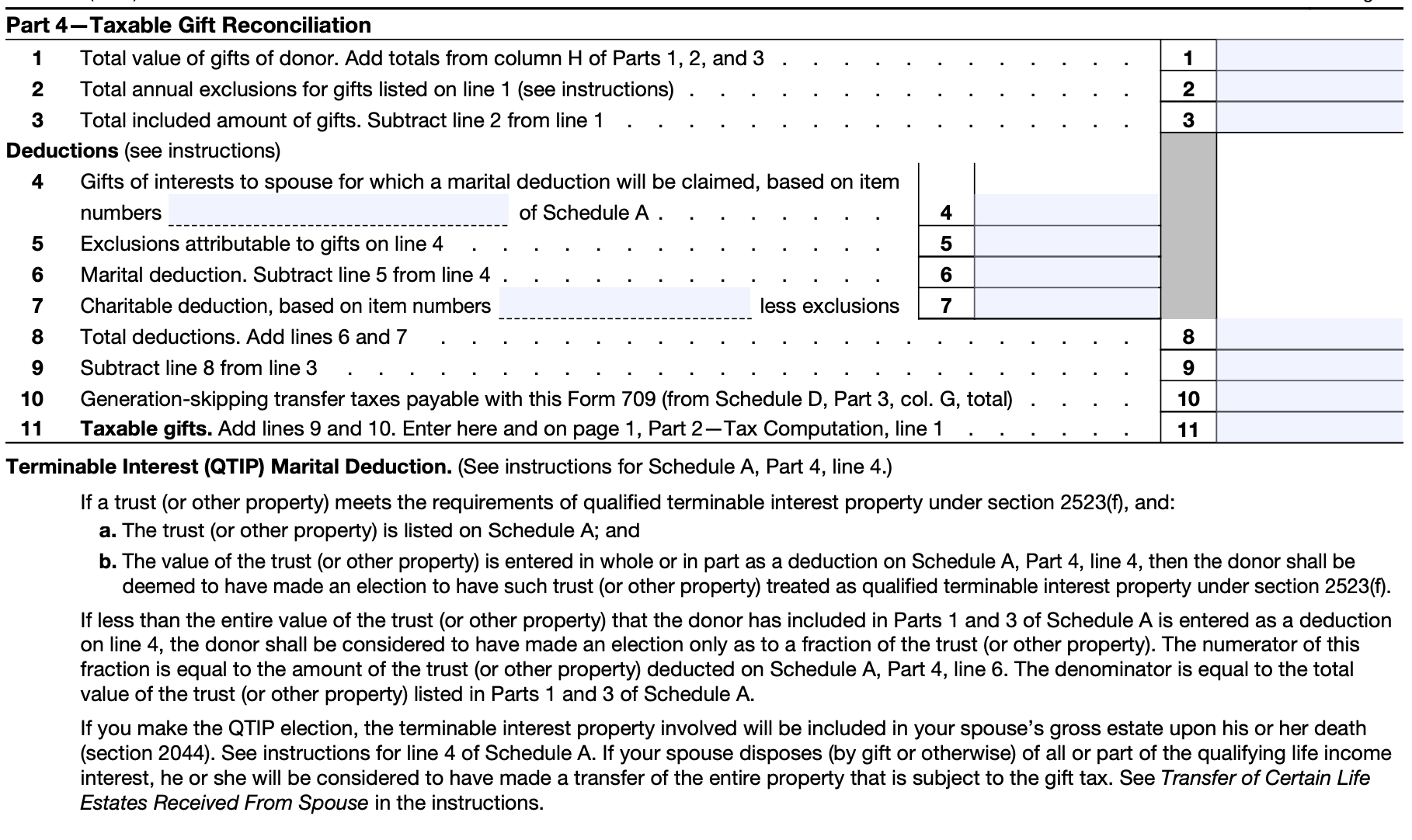

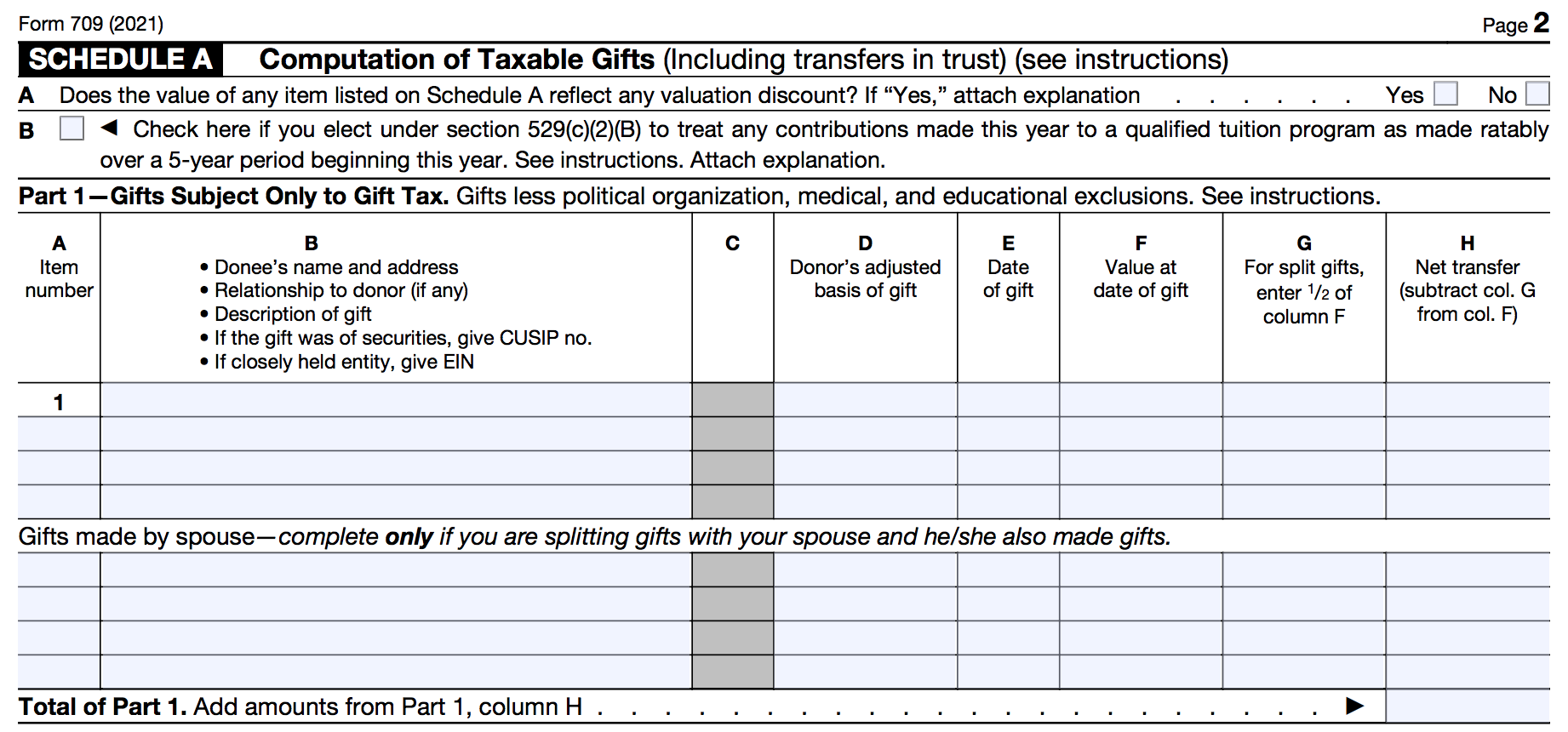

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Planning For Year End Gifts With The Gift Tax Annual Exclusion Somerset Cpas And Advisors

Annual Gift Tax Exclusions First Republic Bank

The Gift Tax Return Exploring Section 529 Western Cpe

Annual Gift Tax Exclusion A Complete Guide To Gifting

Avoid The Gift Tax Return Trap

Trusts That Qualify For The Gift And Gst Tax Annual Exclusions Dw Tax Blog

How Much Can You Gift A Family Member In 2022 Law Offices Of Dupont And Blumenstiel

The Benefits Of Making Annual Exclusion Gifts Before Year End Williams Keepers Llc

Will You Owe A Gift Tax This Year

How To Utilize The Gift Tax Annual Exclusion Buchbinder Tunick Co

Gift Tax Exclusion For Tuition Frank Financial Aid

New Jersey Gift Tax All You Need To Know Smartasset

Annual Gift Tax Exclusion Explained Pnc Insights

The Lifetime Gift Tax Exemption Everything You Need To Know

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

:max_bytes(150000):strip_icc()/149286527-56aa10cd5f9b58b7d000abee.jpg)